The Future of Customer Service: How Co-browsing is Revolutionizing Financial Services Support

In the fast-paced world of financial services, delivering exceptional customer support isn't just about being available—it's about being present, proactive, and precisely helpful. As digital banking becomes increasingly complex, financial institutions face a critical challenge: how to provide seamless, secure assistance that meets the sophisticated expectations of today's customers whilst maintaining operational efficiency.

Enter co-browsing—a game-changing technology that's transforming how financial institutions connect with and support their customers. But what makes this tool particularly revolutionary for the finance sector? Let's delve into the sophisticated world of collaborative browsing and discover why it's becoming the cornerstone of modern customer service strategy.

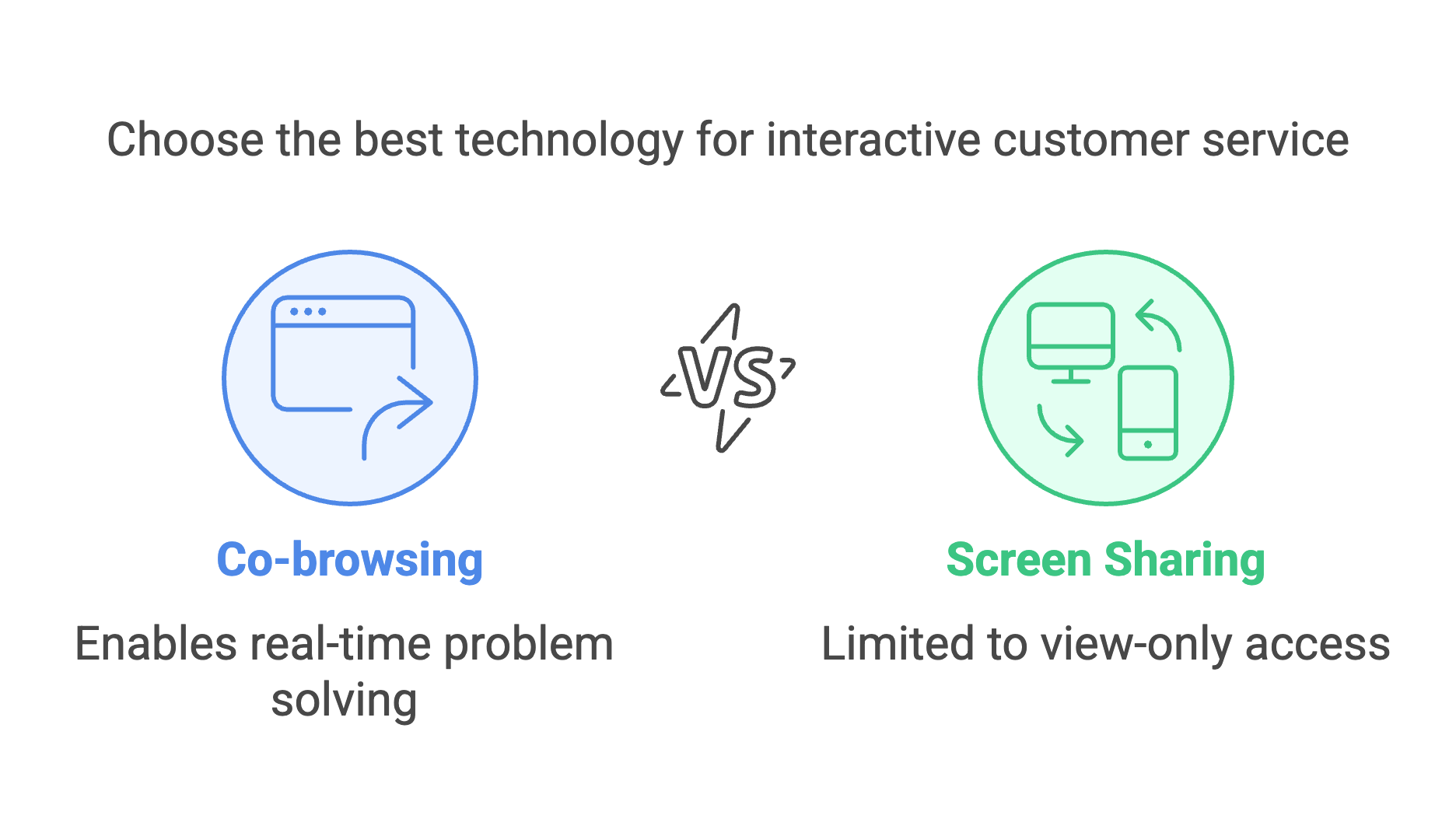

Understanding Co-browsing: Beyond Traditional Screen Sharing

At its core, co-browsing (collaborative browsing) represents a quantum leap in customer service technology. Unlike conventional screen sharing, co-browsing enables customer service representatives to synchronously navigate web pages with customers, creating an interactive, shared digital space where problems can be solved in real-time.

The Critical Distinction: Co-browsing vs Screen Sharing

While both technologies facilitate visual collaboration, the differences are significant:

- Security: Co-browsing only shares the specific browser tab or application, whereas screen sharing exposes the entire desktop

- Installation: Co-browsing requires no downloads or plugins, making it instantly accessible

- Control: Both parties can interact with the shared content in co-browsing, creating true collaboration

- Privacy: Sensitive information can be automatically masked in co-browsing sessions

The Security Imperative: Why Financial Institutions Trust Co-browsing

In an era where data breaches make headlines with alarming frequency, security isn't just a feature—it's a fundamental requirement. Co-browsing technology has evolved to meet the stringent security demands of the financial sector:

- 256-bit SSL encryption for all sessions

- Automatic masking of sensitive form fields

- GDPR and PCI DSS compliance

- Session recording with privacy controls

Transforming Customer Service with Blitzz Co-browse

Blitzz's co-browsing solution stands out in the financial services sector by offering a perfect blend of security, simplicity, and sophistication. The platform enables:

- Instant, no-download collaboration

- Enterprise-grade security protocols

- Seamless integration with existing systems

- Cross-platform compatibility

Real-world Applications in Finance

Financial institutions are leveraging Blitzz co-browsing to:

- Guide customers through complex loan applications

- Assist with investment platform navigation

- Support mobile banking setup

- Facilitate secure document uploads

Measuring Success: The Impact on Key Metrics

The implementation of co-browsing technology has delivered remarkable results across the financial sector:

- 40% reduction in average handling time

- 35% increase in first-call resolution rates

- 25% improvement in customer satisfaction scores

- 50% decrease in form abandonment rates

Implementation Guide for Financial Services

Getting Started with Co-browsing

To implement co-browsing effectively:

- Assess your current customer service infrastructure

- Choose a secure, compliant co-browsing solution

- Train support staff on best practices

- Develop clear usage guidelines

- Monitor and measure performance metrics

Future-proofing Your Customer Service Strategy

As financial services continue to evolve, co-browsing technology is adapting to meet future challenges:

- AI-powered predictive assistance

- Enhanced mobile compatibility

- Advanced analytics capabilities

- Deeper CRM integration

Conclusion: The Co-browsing Advantage

In today's digital-first financial landscape, co-browsing isn't just another tool—it's a competitive necessity. By enabling secure, real-time collaboration between agents and customers, financial institutions can deliver the sophisticated, personalised service that modern customers demand whilst maintaining the highest standards of security and compliance.

Ready to transform your customer service experience? Discover how Blitzz's co-browsing solution can help your institution achieve new levels of customer satisfaction and operational efficiency.

Additional Resources

- Download our comprehensive co-browsing implementation guide

- Schedule a demo of Blitzz co-browsing

- Read customer success stories

Want to learn more about implementing co-browsing in your financial institution? Contact our team of experts today for a personalized consultation.

What is co-browsing, and how is it different from traditional screen sharing?

Co-browsing is a secure, browser-based collaboration tool that allows customer support agents to navigate web pages in real-time alongside customers. Unlike traditional screen sharing, co-browsing only displays browser content—not the entire desktop—and doesn’t require any software downloads. It also includes enhanced security features like field masking and selective sharing, making it especially effective for financial services.

How secure is co-browsing when dealing with sensitive financial data?

Co-browsing is built with multiple layers of security tailored for financial institutions. It offers browser-only visibility, advanced field masking for sensitive data (like account numbers and passwords), end-to-end encryption, and complies with financial regulations such as GDPR and PSD2. Agents can only see what's in the shared browser tab, ensuring customer privacy while delivering effective support.

What measurable benefits can financial institutions expect from using co-browsing?

Financial organizations often see strong improvements across key performance metrics. These include a 20–30% reduction in average handle time, up to a 40% increase in first-call resolution rates, and notable boosts in customer satisfaction scores. Co-browsing also contributes to a 15–25% increase in conversion rates for online applications and form completions.

Does co-browsing require complex technical setup or special hardware?

Not at all. Modern co-browsing solutions like Blitzz are designed to be lightweight and easy to deploy. They don’t require any special hardware and typically integrate with your website using simple JavaScript snippets or API calls. The technology works seamlessly across different browsers and devices—no downloads needed for customers—and can usually be implemented with minimal IT involvement.

How does co-browsing support compliance in the financial sector?

Co-browsing helps ensure compliance through detailed session logging, audit trails, and secure data handling practices. It supports GDPR compliance by adhering to principles like data minimization and purpose limitation, and keeps a record of customer interactions. Field masking ensures that sensitive information stays hidden throughout the session, helping institutions meet strict regulatory standards for privacy and data protection.